Planet Property: The Least and Most Affordable Cities to Buy a Home

Buying a home remains one of life’s biggest financial goals, but where you live can make all the difference. From Detroit’s budget-friendly prices to San Jose’s soaring property costs, housing markets around the world tell very different stories.

For anyone building a new life abroad or setting up a second home in a different country, consider using Remitly to support your financial goals to send money securely across borders.

For anyone building a new life abroad or setting up a second home in a different country, consider using Remitly to support your financial goals to send money securely across borders.

Key findings

- From our analysis of 151 popular cities, the world’s most affordable city to buy a home in is Detroit, Michigan, where the average single earner could comfortably afford a home of their own and couples could afford nearly five times the average property price.

- Germany dominates Europe’s affordability list, with seven of the continent’s top 10 cities offering buyers a stronger chance of owning a home.

- At the other end of the scale, California’s coastal cities claim the top spots as the least affordable in our analysis, with San Jose, Los Angeles and San Diego all featuring in the top five.

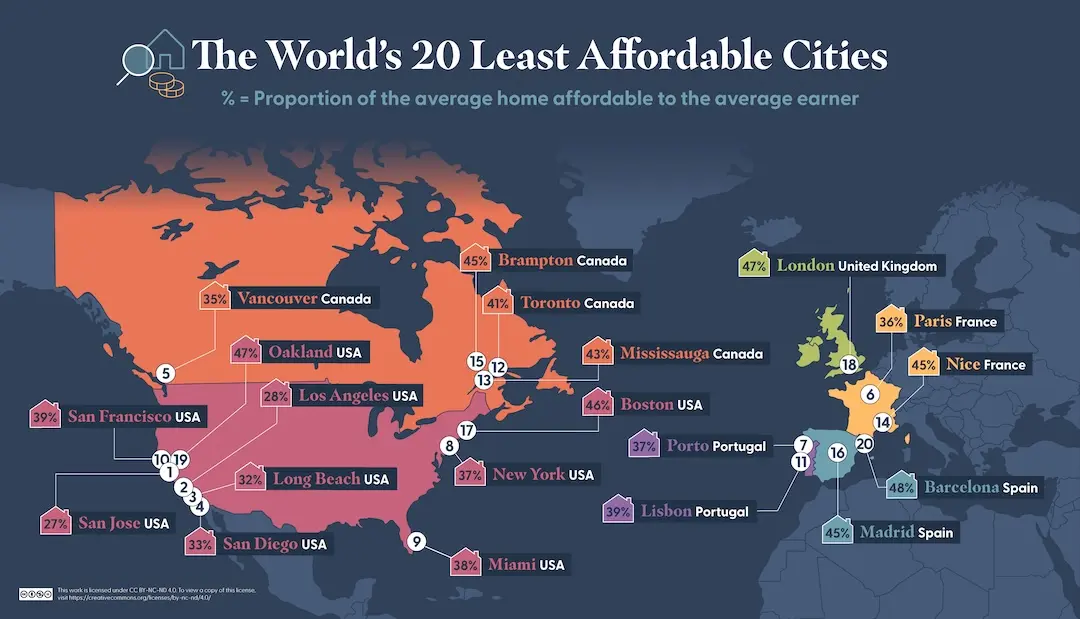

Where in the world is it the hardest to purchase a property?

To discover where in the world you’re most likely to be able to afford to settle down, we analysed more than 150 cities in world’s most popular countries to move to, looking at property prices, average salaries, mortgage rates, interest rates, down payments/deposits and more to unearth where the most and least affordable places to purchase a home are.

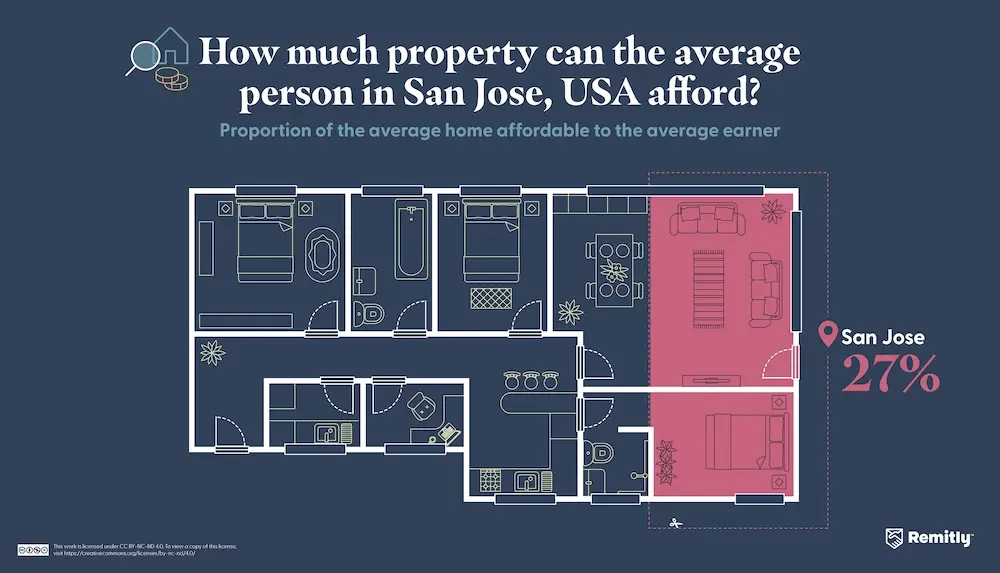

- San Jose, California, USA

Known for being the beating heart of Silicon Valley, where some of the world’s biggest tech giants can be found, it’s also one of the least affordable housing markets in the world. With sky-high prices, even for modest sized properties, many buyers struggle to afford a home of their own, despite strong local incomes[1].

Our study reveals that even a couple, who earn the local average salary ($86,605), pooling their funds together would barely be able to afford half (54.6%) the average property. This could mean they would have to stretch themselves financially, often finding larger down payments or asking for financial help from family to be able to make their dream of owning a home a reality.

Our study reveals that even a couple, who earn the local average salary ($86,605), pooling their funds together would barely be able to afford half (54.6%) the average property. This could mean they would have to stretch themselves financially, often finding larger down payments or asking for financial help from family to be able to make their dream of owning a home a reality.

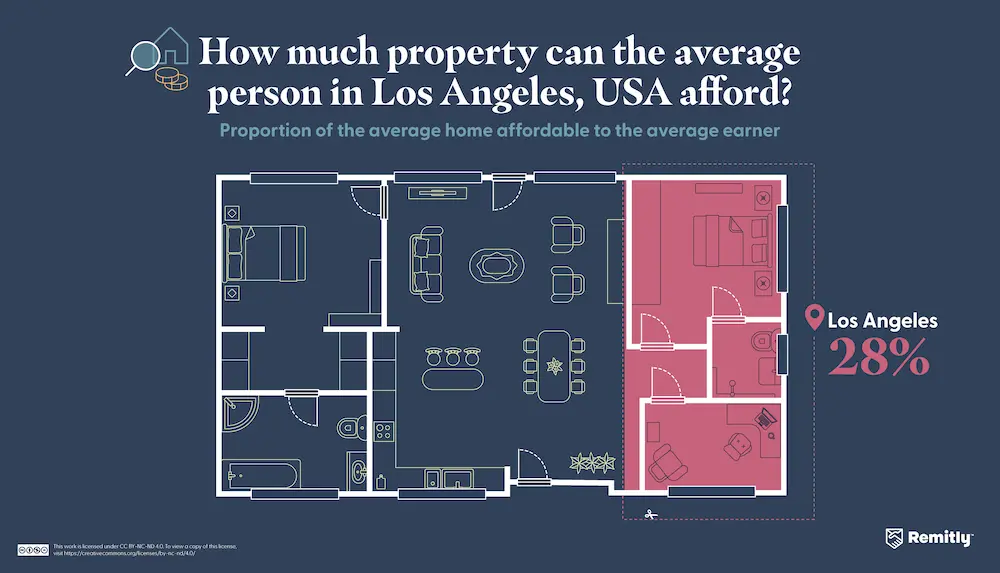

- Los Angeles, California, USA

One of the most iconic cities in the U.S. and home to some of the world’s richest and most famous celebrities, the city stands out as one of the hardest places to buy a home in our dataset. For the average LA resident, the dream of homeownership feels out of reach, as even modest homes come with million-dollar price tags. Despite strong local incomes, thanks to a thriving economy built around entertainment and technology, couples earning the local average salary ($60,656), could just about afford 56.4% of the average home, highlighting how much of a stretch it can be to purchase a home in the City of Angels.

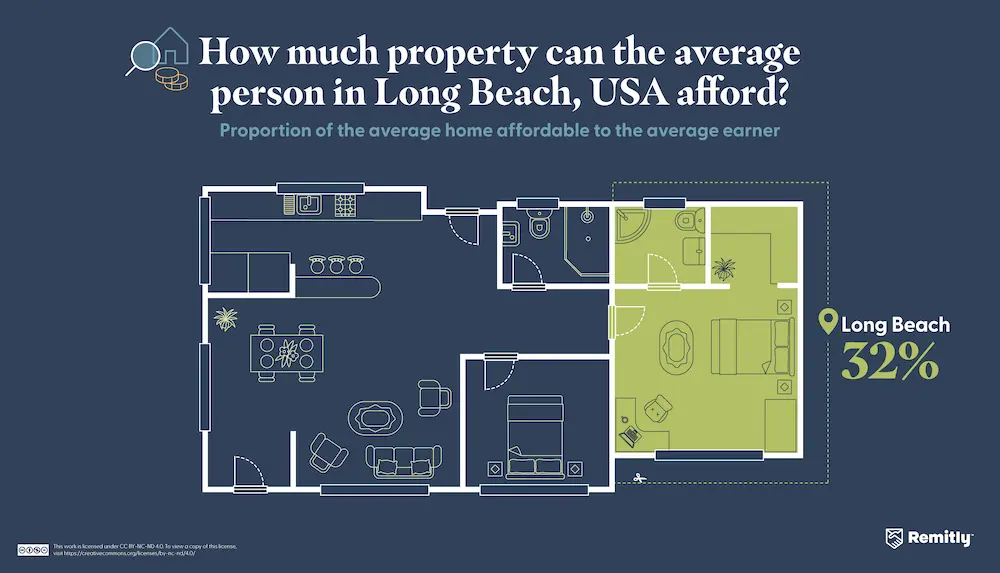

- Long Beach, California, USA

Known for its laid-back lifestyle and within close proximity to Los Angeles, Long Beach is often seen as a more affordable alternative to LA. However, globally, it’s still one of the least affordable cities to buy a home in. Single buyers, earning the average income, can’t quite afford a third (31.7%) of the average home, thanks to pricey properties which have surged over recent years[2], now making it increasingly more difficult to get a foot on the ladder. Even coupled up, residents would have to really stretch their finances by making larger deposits or delaying the purchase process altogether.

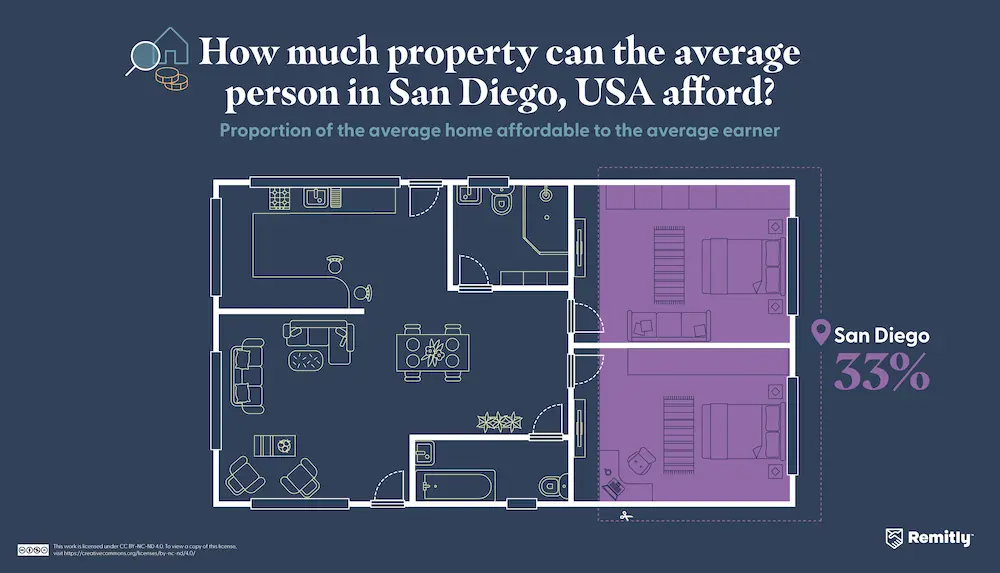

- San Diego, California, USA

Famed for its beaches, year-round sunshine and relaxed coastal lifestyle, settling down in this desirable destination comes at a cost. Despite strong local salaries and a thriving economy driven by tourism, the military, and technology, San Diego the property prices are among some of the highest in the country, meaning even modest homes are out of reach for many aspiring buyers. Those hoping to buy a home in the area need to make larger down payments or rely on family support to secure their forever home.

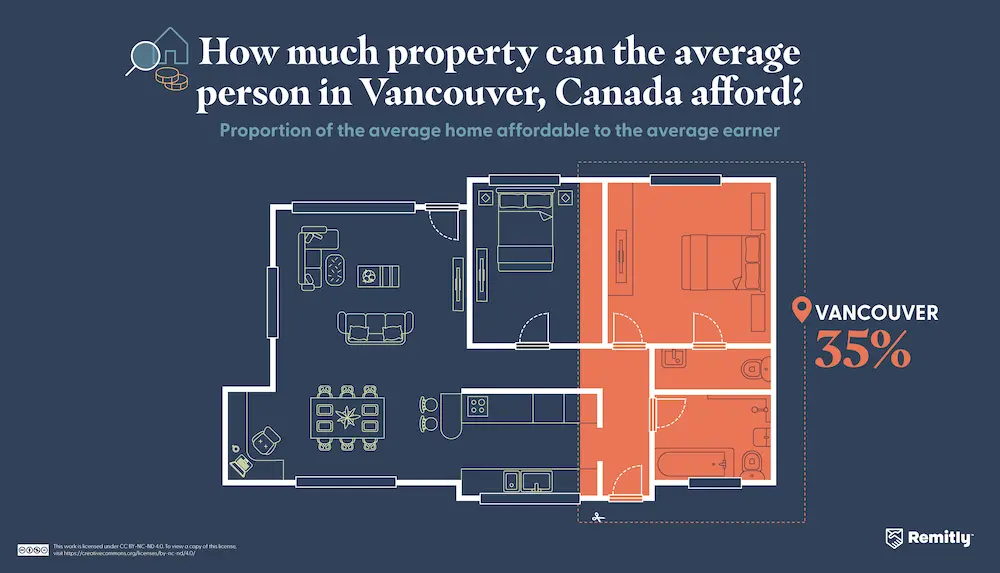

- Vancouver, Canada

Often hailed as one of the most beautiful cities in the world, thanks to being surrounded by mountains and ocean, the cost of homeownership in the Canadian city remains out of reach for many. Our study shows that a single buyer, earning on average $54,778, would be able to afford 34.9% of an average property, and even a couple can only afford almost 70%, meaning those wanting to settle down in the city either have to rely on large deposits, help from family, or turn to the rental market instead.

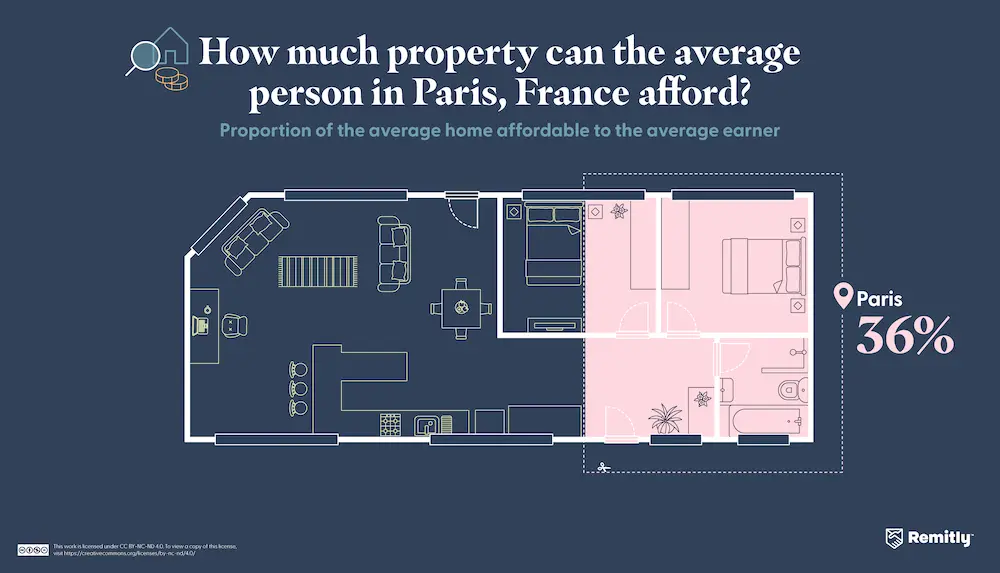

- Paris, France

Outside of North America, Paris is the least affordable city to purchase a home in, based on our analysis, with single residents earning the average wage ($54,700) able to afford just over a third (35.6%) of the average property price. Supply in the premium districts is tight, driving up competition and prices, which can make it difficult for many French residents to buy in their preferred areas. For many, long-term renting is the best alternative, or looking further afield and living outside of the city.

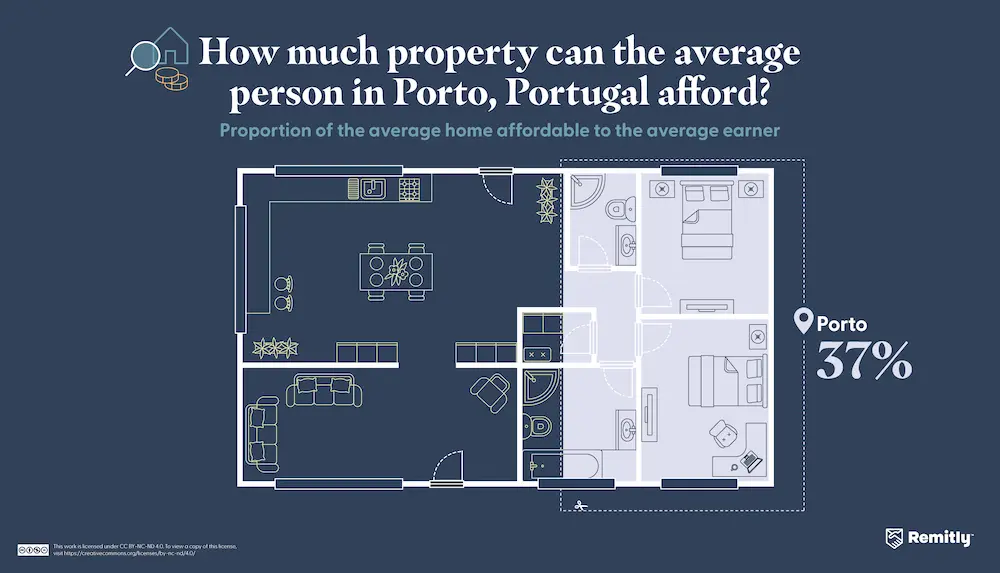

- Porto, Portugal

With colourful riverside homes and a thriving cultural scene, Porto has become a highly sought-after destination. Once known for its affordability compared to other Western European cities, relocation interest, a surge in tourism[3] and investment from foreign sources[4] has transformed the housing market, meaning many locals have been priced out of the market. Our study shows that the average-earning buyer ($20,448 per year) simply can’t afford to get their foot in the door, even if they join forces and try to buy a home as a couple, who both earn average wages.

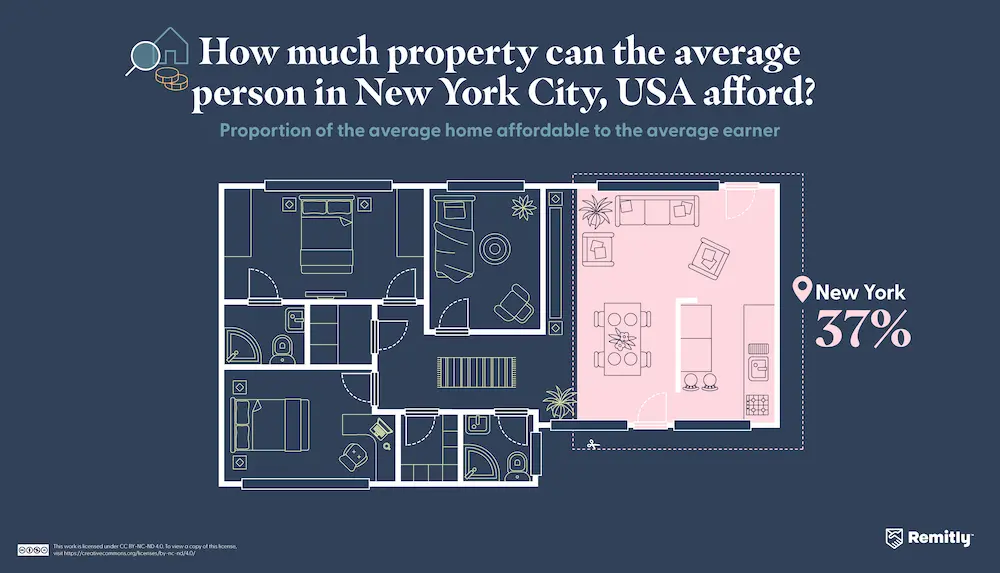

- New York City, New York, USA

One of the world’s most iconic cities, where many move to chase after their dreams, it’s also one of the world’s most expensive and hardest to get onto the property ladder. Even though workers in the city might benefit from higher average salaries ($68,733), many residents still can’t afford a property in the place they call home. With couples only able to afford 74.7% of the average property, those hoping to secure something of their own often need to find additional financial help or look for ways they can be more financially flexible.

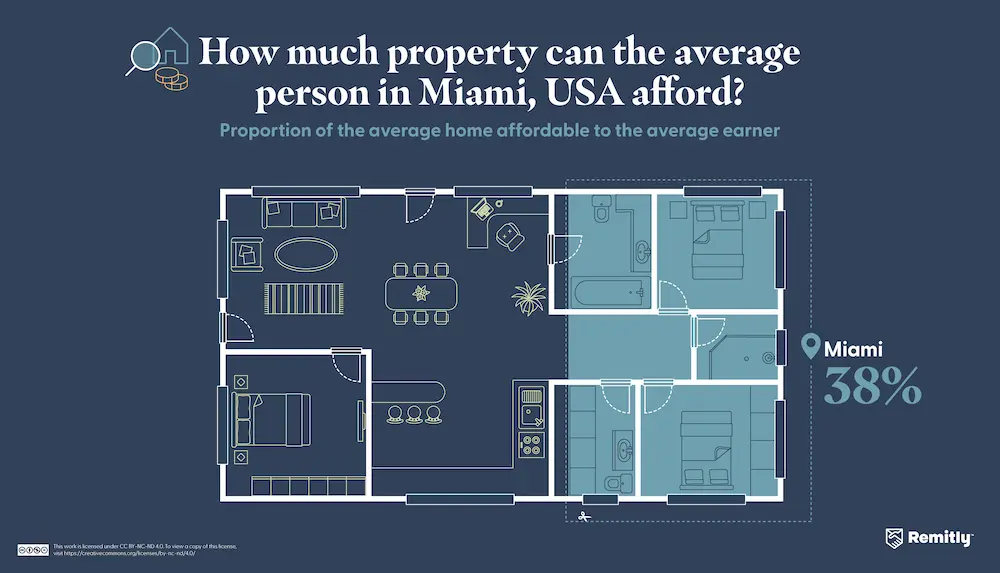

- Miami, Florida, USA

With year-round sunshine, a vibrant culture, and a stunning coastline, Miami is a popular place to settle down, however, it’s also one of the least affordable. The city’s property market has surged in recent years, fuelled by demand from out-of-state buyers, overseas investors, and a growing influx of remote workers hoping to make the most of living by the ocean. Despite a strong local economy, with booming tourism, our study shows that a single buyer doesn’t have much hope of affording their own home without outside help or coming up with a large down payment.

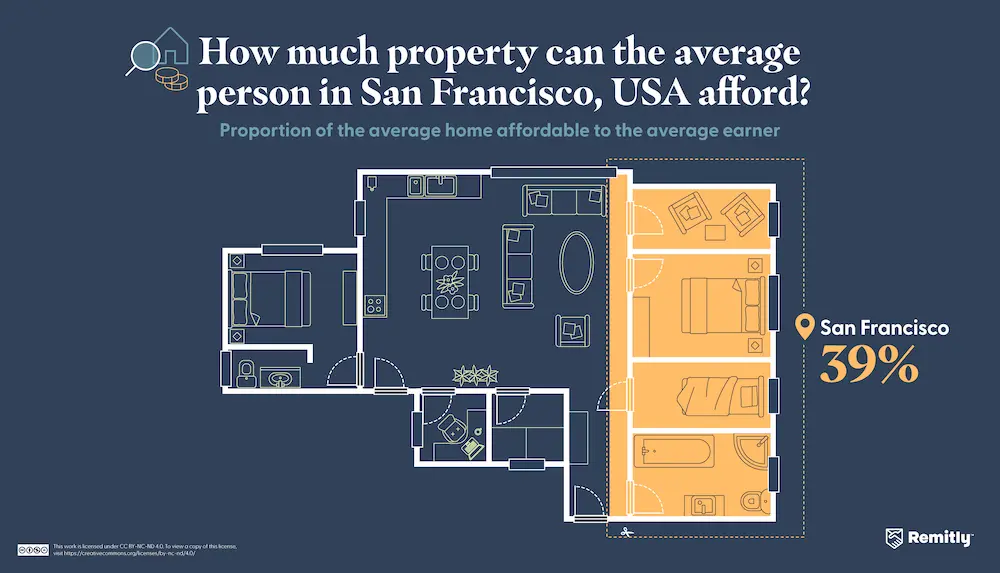

- San Francisco, California, USA

Famous for its Golden Gate views, steep hills and thriving tech industry, San Francisco is a city full of opportunity, however it’s also one of the hardest places to buy a home. With limited housing development, coupled with soaring demand, property prices have been driven up to become some of the highest in the country[5]. Despite high local salaries of an average of $110,581, our study shows that a single buyer with average earnings could only afford 39% of an average property. Even a couple combining their earnings would reach just 77%. With average properties costing so much, a lot of residents are forced into long-term rental agreements or are forced to leave the city in search of more affordable living.

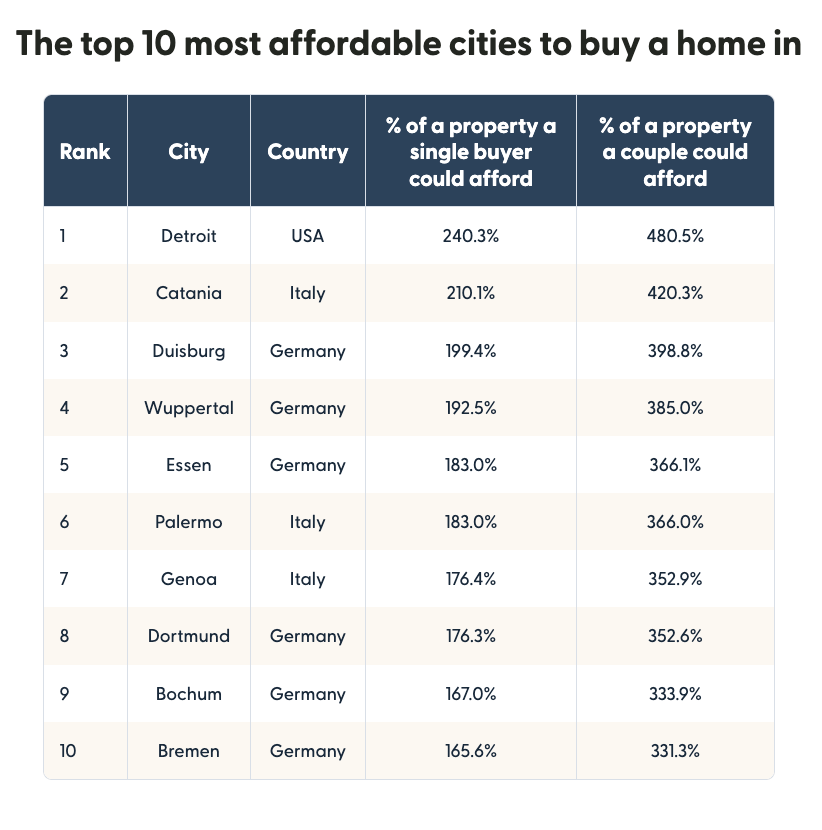

The world’s most affordable cities to buy a home in

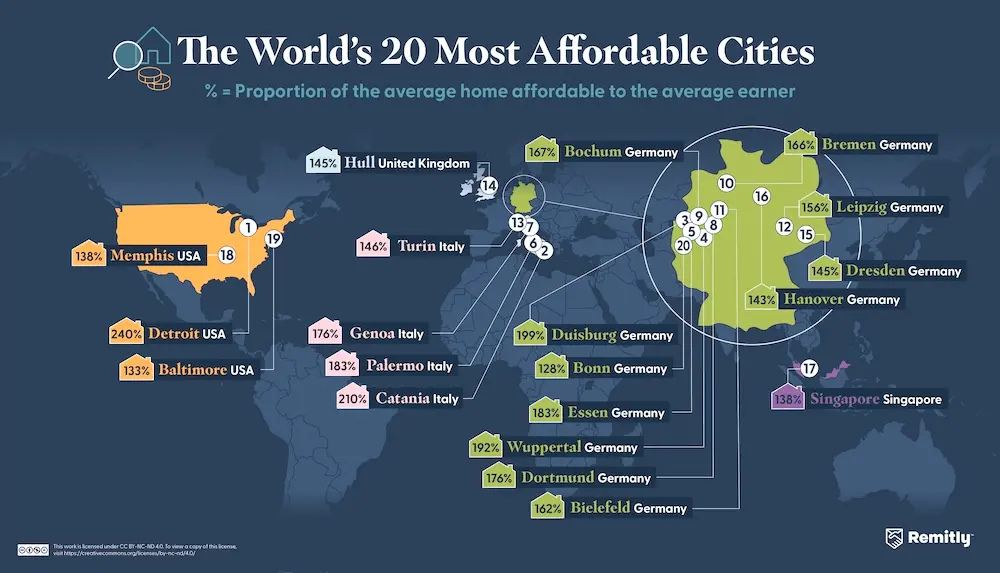

Detroit takes the top spot as the most affordable city to buy a home, with couples earning the average wage able to afford just under five times the average property price. This means they could comfortably afford a home or look to stretch to a property on sale for higher amounts. As Michigan’s largest city, the cost of living is much lower here compared to other areas of the country, which is also reflected in the low average house price of around $78,973.

Following in second place is Catania, an ancient port city located in Sicily, Italy. Singletons in Catania can afford a home of their own, without having to pool their finances with someone else just to get on the ladder. Two additional Italian cities rank among the most affordable locations to buy a property: Palermo and Genoa. Whether supporting family or investing from abroad, you can easily send money to Italy quickly and securely with our services, helping to turn those property ambitions into reality.

Germany claims six of the world’s top 10 most affordable cities, with Duisburg leading the nation, followed by Wuppertal and Essen.

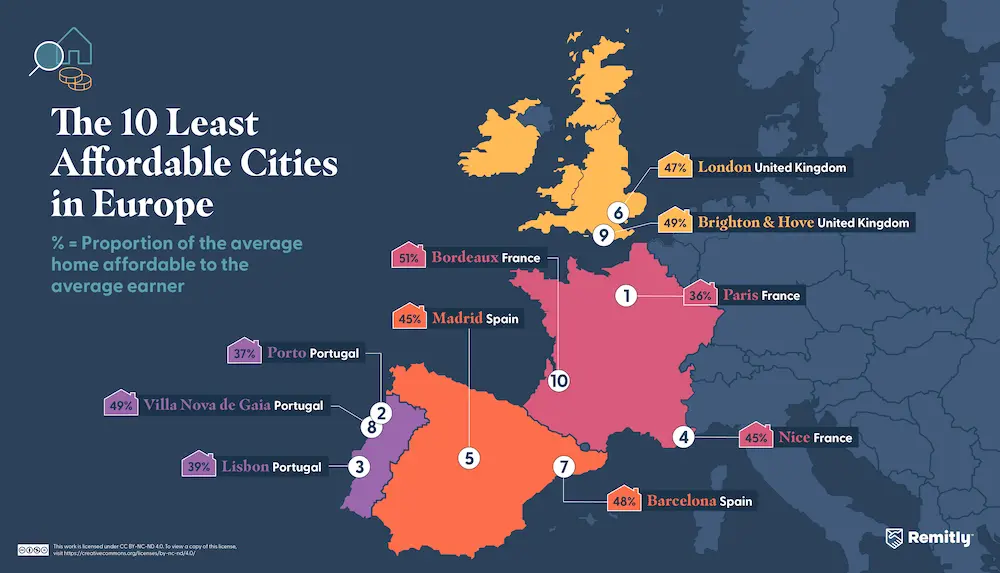

Europe’s least affordable cities to purchase a property

At the top of the list is Paris, France, where a single buyer could only afford 36% of a home, and even couples who pool their finances and savings could only afford 71%. With limited housing supply, tightly controlled rental laws and strong international demand, the French capital remains one of the toughest European markets to purchase a home in.

Buyers in Portugal, particularly in Porto and Lisbon face similar situations, with couples unable to afford a home together, meaning those hoping to go alone in their buying journey are unlikely to be successful without serious financial support or flexibility.

In the UK, London ranks as the sixth least affordable city to purchase a home in, with the English capital proving to be a tough place to settle in for those wanting to get a foot on the ladder. Also making the top 10, is Brighton and Hove - with easy connections into London, many seek solace by the sea, but this comes at a cost, as singletons struggle to own their own space, and couples just about being able to purchase a property together.

Germany home to the most affordable European cities to buy a home in

Ranking second globally for most affordable places to buy a home, it doesn’t come as a surprise that Catania tops the list in the European ranking. Single buyers can afford 210% of an average property, with this figure rising to 420% when buying as a couple.

Duisburg, known for its industrial roots and affordable housing, follows closely in second place. With excellent transport links to Cologne and Düsseldorf, Duisburg and its neighboring cities offer an appealing mix of affordability and accessibility.

German cities make up 70% of the European ranking, highlighting how regional cities across North Rhine-Westphalia provide great opportunities for first-time buyers looking to own a home of their own. And for those hoping to help loved ones make the most of these affordable opportunities, or purchase property themselves, it’s simple to send money to Germany with Remitly.

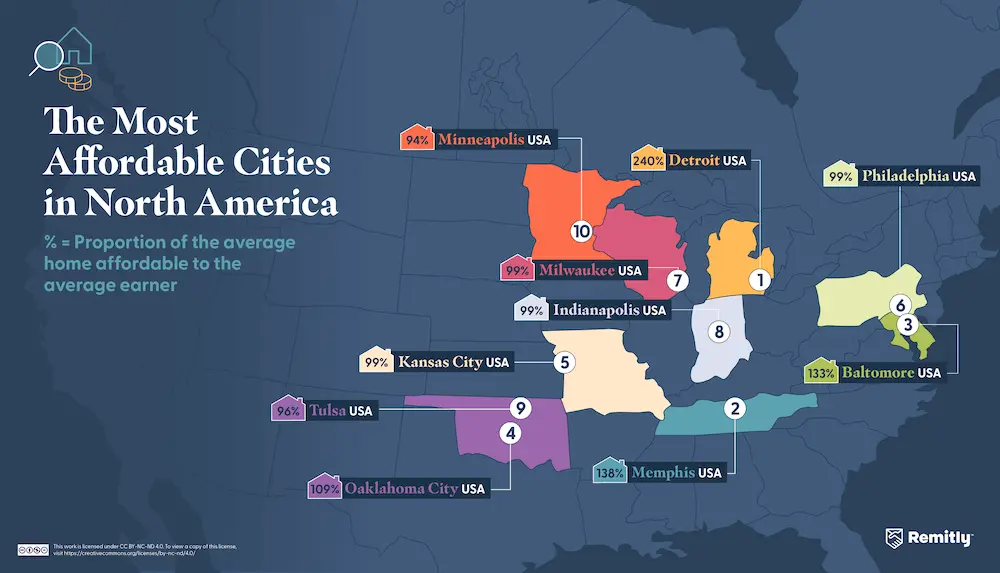

Owning a home in North America

The United States was one of the top countries for immigrant communities in our Immigration Index Report so whether it’s migrants dreaming of making their move more permanent by purchasing a property in the place they founded their new life in, or locals buying a home in the place they grew up in, there are many reasons people would want to get on the property ladder in countries like the U.S. and Canada.

North America’s priciest places to live

Leading the list is San Jose, California, the heart of Silicon Valley, where even couples with high combined incomes can only just afford half of the average property. Close behind are Los Angeles, Long Beach and San Diego, where soaring property prices and fiercely competitive housing markets means homeownership for those on average local salaries feels out of reach.

Further north, across the border in Canada, Vancouver, Toronto and Mississauga also make the list for some of the least affordable cities to purchase a house. Home to many beautiful views, the country is popular for those hoping to settle down and make a life for themselves, however, even couples who try to purchase together struggle to afford the average property.

The Most Affordable Cities in North America

Across North America, affordability varies, with a lot of the coastal cities being some of the hardest to own a property in. However, there are some cities inland where homeownership is less of a distant dream and more achievable for many.

In the United States, Detroit (Michigan) is the most affordable city in the U.S. in our analysis, where couples, who both earn the average salary, could afford nearly five times the cost of an average home. Memphis (Tennessee), Baltimore (Maryland), and Oklahoma City (Oklahoma) make up the top five most affordable places to buy a home, where even those buying alone can make their dream of purchasing a property a reality.

North America’s most affordable cities prove that the dream of owning a home is still alive and well, and for many, it can be something they achieve comfortably, whether it’s going it alone or coupling up and buying together.

For those wanting to send money back home, whether it’s to yourself to invest in a property for your future, or to help a loved one purchase theirs, you can send money quickly and securely with Remitly and make your financial goals feel that little bit closer.

[1] https://data.census.gov

This publication is provided for general information purposes only and is not intended to cover all aspects of the topics discussed herein. This publication is not a substitute for seeking advice from an applicable specialist or professional. The content in this publication does not constitute legal, tax, or other professional advice from Remitly or any of its affiliates and should not be relied upon as such. While we strive to keep our posts up to date and accurate, we cannot represent, warrant or otherwise guarantee that the content is accurate, complete or up to date.

Methodology

This study analyzed 151 cities across 11 countries to compare global housing affordability. The selection included the 50 largest cities by population in the USA; 10 in Canada; 20 in the UK; 10 in Australia; 20 in Germany; 9 in France; 9 in Spain; 10 in Italy; 5 in Portugal; and Singapore. While additional regions such as the UAE and Japan were considered, they were excluded due to insufficient or non-comparable data. Countries were selected as they ranked as the most popular destinations to move to in our recent research, ‘Why the World Wants to Move’. These are areas we hope to explore in future analyses.Average property prices were sourced manually from a range of credible, market-specific sources, including national statistics agencies and real estate databases. For countries where only the average price per square meter was available (Germany, France, Spain, Italy, and Portugal), we calculated the total average property price using Eurostat data on national average property sizes in cities. All property prices were recorded in their local currencies before analysis. Property taxes were not included in the analysis, as they vary significantly between locations and could introduce inconsistencies.

Average annual income figures were obtained from reliable national and regional datasets, including:

- United States: U.S. Census Bureau (American Community Survey) and Neilsberg analysis

- Canada: Statistics Canada and the Fraser Institute

- United Kingdom: Office for National Statistics (ONS)

- Australia: Australian Bureau of Statistics

- Germany: Federal Statistical Office (Destatis), Federal Employment Agency (Bundesagentur für Arbeit), and Statistisches Landesamt Baden-Württemberg

- France: National Institute of Statistics and Economic Studies (INSEE)

- Spain: Spanish Statistical Office (Instituto Nacional de Estadística)

- Italy: National Institute of Statistics (Istituto Nazionale di Statistica)

- Portugal: Ministry of Labour (Gabinete de Estratégia e Planeamento) and National Institute of Statistics (Instituto Nacional de Estatística)

- Singapore: Ministry of Manpower

Sources

[1] https://data.census.gov

[2] https://www.businesswire.com/news/home/20231016926308/en/Los-Angeles-Long-Beach-Glendale-Home-Prices-Up-5.2-Year-Over-Year-According-to-First-American-Data-Analytics-Monthly-Home-Price-Index-Report

[3] https://www.portobest.city/post/porto-s-tourism-booms-in-2024

[4] https://www.portugalglobal.pt/en/news/2025/may/foreign-direct-investment-reaches-record-levels-in-porto

[5] https://www.axios.com/local/san-francisco/2025/02/25/sf-home-prices-increase-housing-inventory

This publication is provided for general information purposes only and is not intended to cover all aspects of the topics discussed herein. This publication is not a substitute for seeking advice from an applicable specialist or professional. The content in this publication does not constitute legal, tax, or other professional advice from Remitly or any of its affiliates and should not be relied upon as such. While we strive to keep our posts up to date and accurate, we cannot represent, warrant or otherwise guarantee that the content is accurate, complete or up to date.