*Migration Observatory data reflects Q1 2019 to Q3 2024, the latest available as of August 2025.

Transfers are commonly used to support things like extended family living abroad, fund education, and invest in property, reinforcing deep financial ties between the two nations.

These regulations lead to the increased use of bank transfers, often limiting the use of mobile wallets or informal money transfer channels. This results in higher average fees of around 6.30% for £148 transfers across over 80 providers.³ This also often means slower processing times for many remittance transfer companies compared to links like India or Pakistan.

This infrastructure has driven significant growth in the remittance climate, especially for rural populations with limited banking access.

Overseas Filipino Workers (OFWs) often send money home to help cover their family’s essentials like food, housing, healthcare, and education, as well as putting some aside for their own savings for the future. They also often purchase goods and make investments overseas.

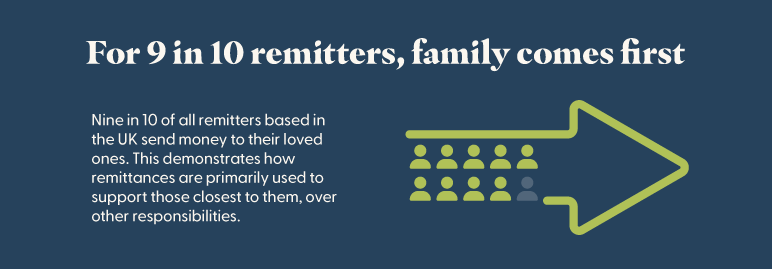

Many migrants view sending money abroad as a moral responsibility, often prioritising family needs over personal savings.

Instead, support is often directed toward informal borrowing arrangements between family and friends.

For some senders, this means purchasing land or a home to retire abroad. For others, it’s seed money for a small business or tuition fees to help relatives gain qualifications.

This regularity indicates many senders' dual responsibilities – maintaining their lives in the UK while providing crucial financial support to family or communities abroad.

The figure is slightly lower for those from the Middle East, North Africa, and Central Asia, as 37% send money abroad. In contrast, only 8% of UK-born nationals remit money.

In Germany, personal remittances account for just 0.5% of GDP, while this figure is 1.2% for France. This difference reflects a strong domestic economy and a large foreign-born population sending money abroad. These transfers include all money sent between resident and non-resident parties, as well as employee compensation.

This level of dependence often coexists with migration due to economic hardship or instability. Remittances are often essential for needs like food, education, and healthcare.

Pakistan (9.4% of GDP) and Bangladesh (6.0%) show higher proportional reliance. These remittances affect rural income, foreign exchange stability, and poverty alleviation.

This injection of foreign currency can help communities cover essential costs like food, rent, and medical care.

However, high remittance reception doesn’t necessarily mean high dependence. Unlike in many lower-income countries, where remittances are used to cover essentials like food or healthcare, funds sent to China could be directed toward long-term investments. This means they tend to function as a tool for upward wealth-building, rather than a basic safety net.

These inflows reflect the reality that transnational financial ties are not one-way. In both countries, significant immigrant and expatriate populations maintain strong links to their homelands, while citizens living or working overseas often spend money abroad, invest overseas, and use international savings accounts.

Despite accounting for just 0.1% of GDP, the UK ranks among the top 40 remittance-receiving nations globally.

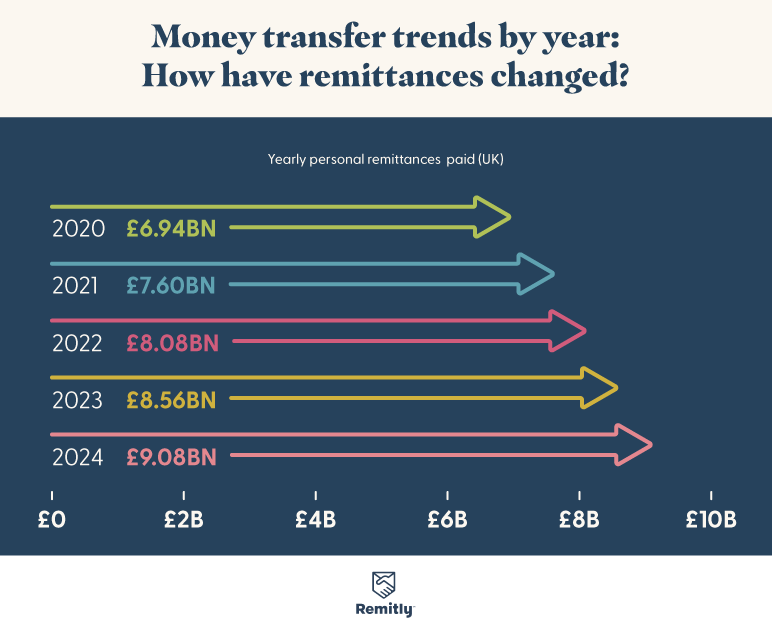

The increase reflects inflation-adjusted transfers and the growing number of migrants and dual-residency workers maintaining financial ties to their home countries. Net migration in 2024 was lower than in 2022 and 2023, at 431,000, according to The Migration Observatory.

Despite this, it was still much higher than migration during the 2010s, which sat at around 200,000 to 300,000. It also highlights the UK’s role as a key global remittance hub.

This surge has come alongside a boom in fintech and mobile remittance platforms, making it easier for senders to remit funds frequently and in smaller increments.

This annual growth rate reflects sustained momentum in international transfers. It suggests that remittance behaviour is now an embedded financial habit for many UK residents, rather than a response to a short-term crisis.

As global migration continues to rise, this figure will likely trend upward in 2025 and future years.

Total personal remittances received (as % of GDP & in USD), personal remittances paid for each country were sourced from the following World Bank sources:

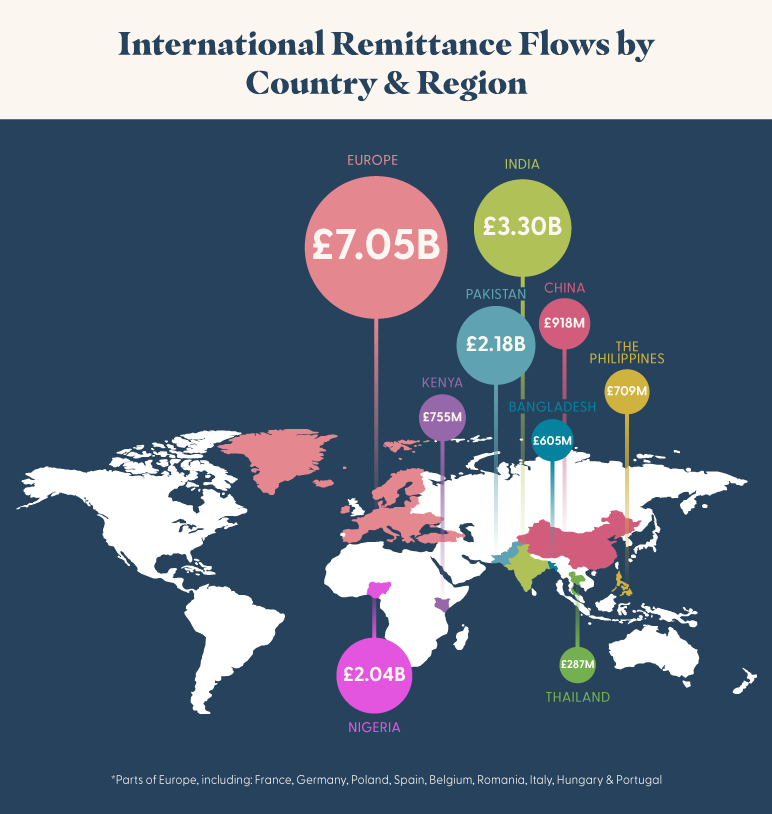

The largest destination countries for remittances sent from the UK were sourced from the World Bank bilateral remittance matrix, via the Migration Observatory.

The World Bank's Remittance Prices Worldwide was used to calculate:

Note that for payment methods, records containing multiple methods (e.g., “Cash, Debit card”) were split into separate groupings (e.g., “Cash” and “Card”) to avoid duplication.

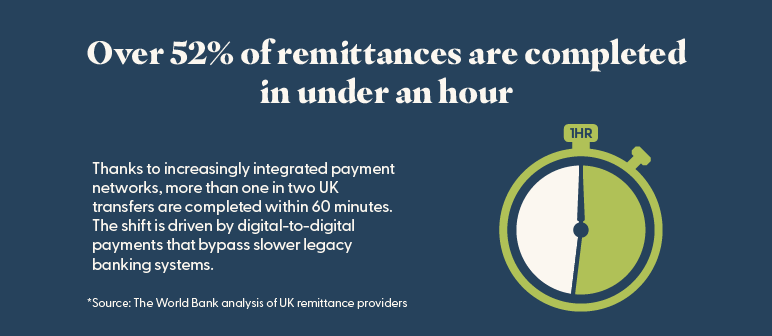

Average delivery speeds were also calculated using the above data. These categories (e.g., “Less than one hour” and “Next day”) were counted across all records (2019–2024). The percentage of total quotes was calculated for each speed category, and a weighted average delivery time was estimated by assigning approximate hours to each category.

The most common reasons for sending money abroad and the proportion of UK residents sending remittances were sourced from the Migration Observatory's analysis of UKHLS data.

All figures were converted from USD to GBP on August 14th, 2025, using Remitly’s currency converter. This currency conversion was done using Remitly’s new customer rate and does not include any fees that a service, like Remitly, may charge in a scenario like this when sending money abroad. Rates are subject to change and may be subject to sending limits.

Remitly data comes from a market research survey by Remitly of 3,548 remittance senders located in eight send countries (including Remitly customers as well as those who have used other money transfer providers) about the occasions they have sent for in the last 12 months; survey fielded September 19 to October 9, 2024.

UK data comes from the same market research survey by Remitly, speaking to 238 remittance senders located in the country.

ENDNOTES

¹ https://migrationobservatory.ox.ac.uk/resources/briefings/migrant-remittances-to-and-from-the-uk/